Writing a Personal Finance Blog sets the stage for your financial journey, blending style with substance as you navigate the world of money management and wealth building.

Get ready to dive into the essentials of starting, growing, and monetizing your blog, all while connecting with a vibrant online community.

Introduction to Personal Finance Blogging

Personal finance blogging is a platform where individuals can share insights, tips, and advice on managing their finances effectively. It serves as a valuable resource for readers seeking guidance on budgeting, saving, investing, and other financial topics.

Discussing personal finance through blogging is essential as it helps raise awareness about the importance of financial education. Many people lack the necessary knowledge and skills to make informed financial decisions, leading to financial struggles and debt. By sharing personal experiences and expertise, bloggers can help educate their audience and empower them to take control of their financial future.

Benefits of Starting a Personal Finance Blog

- Build a community: Through blogging, you can connect with like-minded individuals who share an interest in personal finance. Building a community of readers can provide support, encouragement, and valuable feedback.

- Share knowledge: By sharing your financial journey, tips, and strategies, you can help others learn from your experiences and avoid common financial pitfalls.

- Monetization opportunities: Personal finance blogging can also be a source of income through affiliate marketing, sponsored content, or selling digital products like e-books or courses.

- Personal growth: Running a personal finance blog can help you improve your own financial literacy and discipline as you research and write about various financial topics.

Setting Up Your Personal Finance Blog

To start your personal finance blog, follow these steps to set up the foundation for a successful platform.

Choose a Domain Name

When selecting a domain name for your personal finance blog, opt for something catchy, easy to remember, and relevant to the niche you will be focusing on. Consider including s related to personal finance to improve search engine optimization.

Select a Hosting Service

Research different hosting services to find one that offers reliable uptime, good customer support, and scalability as your blog grows. Consider factors like storage space, bandwidth, and security features before making a decision.

Install a Content Management System (CMS)

Choose a user-friendly CMS like WordPress to build and manage your blog. WordPress offers a variety of themes and plugins specifically designed for bloggers, making it easy to customize your site’s layout and functionality.

Create Essential Pages

Set up key pages such as About Me, Contact, and Disclaimer to provide important information to your readers. These pages help establish credibility and build trust with your audience.

Design Your Blog Layout

Focus on creating a clean and organized layout for your personal finance blog. Use a simple color scheme, intuitive navigation menus, and clear typography to enhance user experience and readability.

Plan Your Content Strategy

Develop a content strategy that aligns with your blog’s goals and target audience. Consider creating a content calendar to schedule regular posts and maintain consistency in publishing.

Set Up Social Media Profiles

Create social media accounts for your blog on platforms like Twitter, Facebook, and Instagram to promote your content and engage with your audience. Consistent branding across all channels helps build a strong online presence.

Optimize for

Implement basic search engine optimization strategies like using relevant s, optimizing meta tags, and creating high-quality content to improve your blog’s visibility in search engine results.

Monetization Strategy

Explore different monetization options such as affiliate marketing, sponsored content, and display advertising to generate income from your personal finance blog. Experiment with various strategies to find what works best for your audience.

Stay Consistent and Engage with Your Audience

Consistency is key to growing your personal finance blog. Stay active by posting regularly, responding to comments, and engaging with your readers to build a loyal following over time.

Creating Engaging Content for Your Personal Finance Blog

When it comes to creating engaging content for your personal finance blog, there are several types of posts you can consider. From informative articles to personal stories, each type of content plays a crucial role in attracting and retaining readers. Here are some tips on how to make your personal finance blog posts compelling and the importance of incorporating storytelling into your content.

Types of Content for Your Personal Finance Blog

- Informative Articles: Share valuable tips, tricks, and insights on personal finance topics such as budgeting, saving, investing, and more.

- How-To Guides: Provide step-by-step instructions on financial tasks like creating a budget, setting financial goals, or investing in stocks.

- Personal Stories: Share your own experiences with money management, budgeting challenges, or financial successes to connect with your audience on a personal level.

- Listicles: Create lists of financial tips, tools, or resources to make your content easily digestible and shareable.

Tips for Writing Compelling Personal Finance Blog Posts

- Start with a Strong Headline: Capture readers’ attention with a compelling headline that clearly conveys the value of your post.

- Use Clear and Concise Language: Avoid jargon and complex terms to make your content accessible to a wide audience.

- Include Visuals: Incorporate images, infographics, or charts to enhance your posts and make complex concepts easier to understand.

- Provide Actionable Advice: Offer practical tips and strategies that readers can implement in their own financial lives.

- Engage with Your Audience: Encourage reader interaction through comments, polls, or surveys to foster a sense of community on your blog.

The Importance of Using Storytelling in Your Finance Blog Content

Storytelling is a powerful tool for personal finance bloggers as it helps to humanize financial topics and make them more relatable to readers. By sharing personal anecdotes, case studies, or real-life examples, you can convey complex financial concepts in a way that resonates with your audience. Stories create emotional connections, making your content more memorable and engaging. Incorporating storytelling into your finance blog content can help you build trust with your readers and establish yourself as a credible source of financial information.

Monetizing Your Personal Finance Blog: Writing A Personal Finance Blog

When it comes to making money from your personal finance blog, there are several strategies you can explore to turn your passion for financial literacy into a profitable venture. From affiliate marketing to generating passive income, here are some ways you can monetize your blog:

Affiliate Marketing for Personal Finance Bloggers, Writing a Personal Finance Blog

Affiliate marketing is a popular monetization strategy for personal finance bloggers. By partnering with companies and promoting their products or services through affiliate links on your blog, you can earn a commission for every sale or lead generated through your referral. Here are some pros and cons of affiliate marketing for personal finance bloggers:

- Pros:

- Opportunity to earn passive income through commissions

- Ability to promote products/services you believe in

- Flexible work schedule and potential for high earnings

- Cons:

- Dependence on third-party companies for payouts

- Potential for competition and saturation in certain niches

- Need to disclose affiliate relationships to maintain transparency

Affiliate marketing can be a lucrative way to monetize your personal finance blog, but it’s essential to strike a balance between promotional content and valuable information for your audience.

Generating Passive Income Through Your Blog

In addition to affiliate marketing, there are other ways to generate passive income through your personal finance blog. Here are some tips to help you maximize your earnings:

- Offer premium content or services for a subscription fee

- Monetize your blog through display advertising with platforms like Google AdSense

- Create and sell digital products such as e-books, courses, or templates

- Explore sponsored content opportunities with brands relevant to your niche

By diversifying your income streams and providing valuable content to your audience, you can build a sustainable revenue model for your personal finance blog.

Building a Community and Growing Your Personal Finance Blog

Building a community around your personal finance blog is crucial for its growth and success. Engaging with your audience and fostering a sense of community can help you establish a loyal following and increase your blog’s visibility. Here are some strategies to help you build a community and grow your personal finance blog:

Engaging with Your Audience

One of the key aspects of building a community is engaging with your audience. Respond to comments on your blog posts, ask for feedback, and encourage discussions among your readers. Show your audience that you value their input and are interested in their thoughts and opinions.

Fostering a Sense of Community

Create a sense of community among your readers by organizing events such as webinars, workshops, or meetups. Encourage your audience to interact with each other by creating a forum or a Facebook group where they can discuss personal finance topics and share their experiences. Building a community where members can support and learn from each other will help increase engagement on your blog.

Promoting Your Personal Finance Blog

To increase the visibility of your personal finance blog, promote it on social media platforms, collaborate with other personal finance bloggers, and guest post on relevant websites. Use search engine optimization () techniques to improve your blog’s ranking on search engine results pages and attract more organic traffic. Engaging with your audience on social media and responding to their comments and messages will also help increase your blog’s reach.

Legal and Ethical Considerations for Personal Finance Bloggers

When running a personal finance blog, it is crucial to adhere to important legal and ethical considerations to ensure transparency and credibility. This includes incorporating disclaimers and disclosures, providing accurate financial information, and upholding ethical practices.

Disclaimers and Disclosures

- Include a disclaimer on your blog to inform readers that the information provided is for educational purposes only and not personalized financial advice.

- Disclose any potential conflicts of interest, sponsored content, or affiliate links to maintain transparency with your audience.

- Consult with a legal professional to ensure your disclaimers and disclosures comply with relevant laws and regulations.

Ensuring Accuracy of Financial Information

- Verify the sources of your financial information to ensure accuracy and reliability before sharing it with your audience.

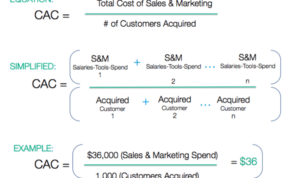

- Double-check numerical data, statistics, and calculations to avoid misinformation that could harm your credibility.

- Consider citing reputable sources and fact-checking information to provide valuable and trustworthy content to your readers.

Importance of Ethical Practices

- Act ethically by prioritizing the best interests of your audience and avoiding deceptive practices or misleading claims in your content.

- Respect the privacy of your readers and refrain from sharing sensitive information without consent or proper authorization.

- Foster a culture of trust and integrity within your personal finance blog community to build long-lasting relationships with your audience.