Yo, diving into Customer Acquisition Cost, where we break down how businesses can finesse their marketing game to attract customers without breaking the bank. Get ready for some serious knowledge drop!

In this guide, we’ll explore the factors influencing CAC, strategies to optimize it, and how to calculate and analyze it like a boss. Let’s get into it!

What is Customer Acquisition Cost (CAC)?

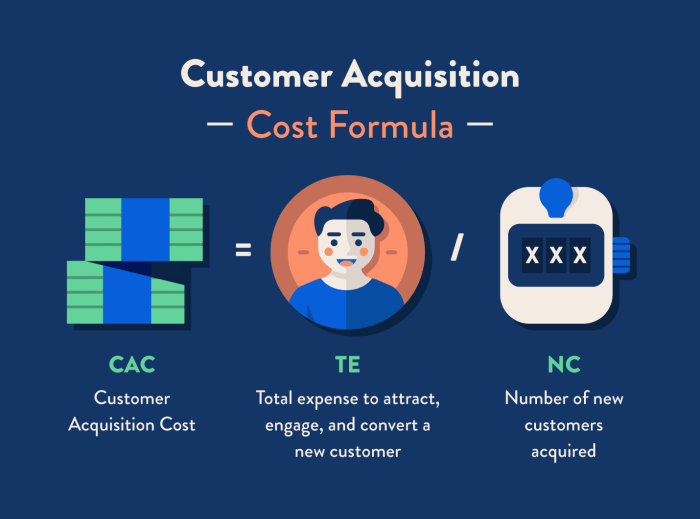

Customer Acquisition Cost (CAC) is the total cost a business incurs to acquire a new customer. This includes expenses related to marketing, sales, and other activities aimed at attracting and converting potential customers.

Importance of Understanding CAC

Understanding CAC is crucial for businesses because it helps them evaluate the effectiveness of their marketing and sales strategies. By knowing how much it costs to acquire a customer, companies can make informed decisions about resource allocation and budgeting.

Calculation of CAC

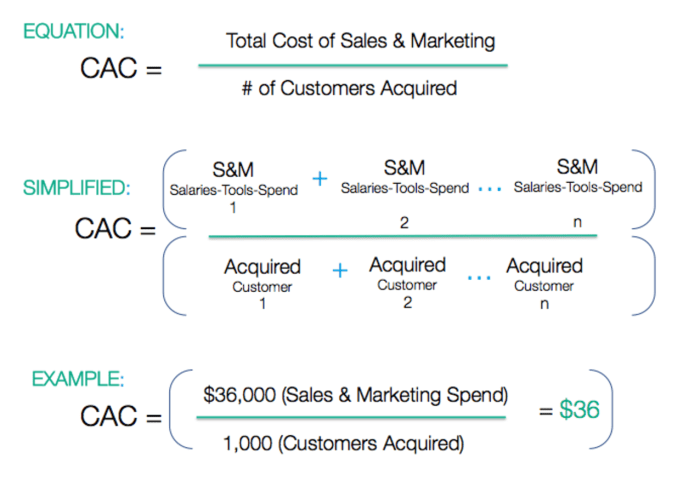

Calculating CAC involves dividing the total costs associated with acquiring customers by the number of customers acquired within a specific time period. The formula for CAC is:

CAC = Total Costs / Number of Customers Acquired

For example, if a company spends $10,000 on marketing and sales efforts in a month and acquires 100 new customers during that same period, the CAC would be $100 per customer.

Factors influencing Customer Acquisition Cost

When it comes to Customer Acquisition Cost (CAC), there are several key factors that can have a significant impact on the overall cost of acquiring new customers. Understanding these factors is crucial for businesses looking to optimize their marketing strategies and improve their bottom line. Let’s dive into some of the main factors that influence CAC.

Marketing Channels

Marketing channels play a crucial role in determining the Customer Acquisition Cost. Different channels have varying costs associated with acquiring customers. For example, acquiring customers through paid advertising on social media platforms like Facebook or Instagram may have a higher CAC compared to organic search or email marketing. It’s essential for businesses to analyze the performance of each marketing channel to allocate resources effectively and minimize CAC.

Customer Lifetime Value

Customer Lifetime Value (CLV) is another factor that influences Customer Acquisition Cost. CLV refers to the total revenue a customer is expected to generate over the entire duration of their relationship with a business. Understanding the CLV allows businesses to determine how much they can afford to spend on acquiring new customers while still maintaining profitability. By focusing on increasing CLV through customer retention and loyalty programs, businesses can effectively reduce their CAC and improve overall profitability.

Strategies to optimize Customer Acquisition Cost

When it comes to optimizing Customer Acquisition Cost (CAC), businesses need to focus on cost-effective marketing strategies, targeting the right audience, and improving conversion rates. By implementing these strategies, companies can reduce their CAC and increase their overall profitability.

Cost-effective Marketing Strategies

- Utilize social media platforms to reach a wider audience at a lower cost.

- Implement content marketing strategies such as blogging, , and email marketing to attract and engage potential customers.

- Collaborate with influencers or industry partners to leverage their audience and credibility.

- Utilize referral programs to encourage existing customers to refer new customers.

Targeting the Right Audience

- Conduct thorough market research to identify the demographics, interests, and behaviors of your target audience.

- Use data analytics to create personalized marketing campaigns that resonate with your target audience.

- Focus on quality leads over quantity to ensure that your marketing efforts are reaching potential customers who are likely to convert.

Improving Conversion Rates, Customer Acquisition Cost

- Optimize your website and landing pages for user experience and conversion rate optimization.

- Implement A/B testing to identify which marketing strategies are most effective in converting leads into customers.

- Provide clear calls-to-action and incentives to encourage visitors to take the desired action.

- Follow up with leads through email marketing and retargeting strategies to nurture them through the sales funnel.

Calculating and analyzing Customer Acquisition Cost

When it comes to understanding the effectiveness of your marketing efforts, calculating and analyzing Customer Acquisition Cost (CAC) is crucial. CAC helps businesses determine how much it costs to acquire a new customer, which is essential for making informed decisions and optimizing marketing strategies.

Calculating CAC

To calculate CAC, you need to divide the total costs associated with acquiring customers (marketing and sales expenses) by the number of customers acquired during a specific period. The formula for calculating CAC is:

CAC = Total Marketing and Sales Costs / Number of Customers Acquired

- Identify all costs related to acquiring customers, including advertising, sales team salaries, and any other expenses directly tied to customer acquisition.

- Determine the total number of customers acquired during a specific time frame, usually monthly or annually.

- Divide the total costs by the number of customers acquired to get the CAC.

Benchmarking CAC

Benchmarking CAC against industry standards is essential to understand how your customer acquisition costs compare to competitors and the market average. By benchmarking CAC, businesses can assess their cost-effectiveness and identify areas of improvement.

- Compare your CAC to industry averages to see if you are spending more or less than your competitors on acquiring customers.

- Identify trends in CAC over time to gauge the effectiveness of your marketing and sales strategies.

- Use benchmarking data to set realistic goals for lowering CAC and improving overall efficiency.

Analyzing CAC for Informed Decisions

Analyzing CAC can provide valuable insights into the performance of your marketing campaigns and help in making informed business decisions. By understanding CAC, businesses can allocate resources more effectively and optimize their customer acquisition strategies.

- Identify which marketing channels have the lowest CAC and focus your efforts on those channels to maximize ROI.

- Track changes in CAC to assess the impact of marketing campaigns and adjust strategies accordingly.

- Use CAC analysis to forecast future customer acquisition costs and budget effectively for marketing initiatives.