Real Estate Investing Tips kick off with a bang, giving you the lowdown on how to build wealth through savvy investments in the property market. From residential to commercial properties, we’ve got you covered.

Get ready to dive deep into the world of real estate investing and discover the key strategies for success in this lucrative field.

Overview of Real Estate Investing

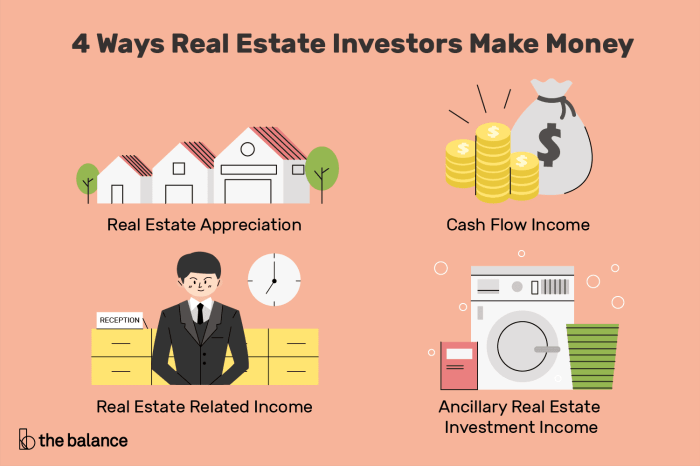

Real estate investing involves purchasing, owning, managing, renting, or selling properties for profit. It is a popular way to build wealth and generate passive income over time.

Investing in real estate offers various benefits compared to other investment options. Some key advantages include:

Types of Real Estate Investments

- Residential Properties: These include single-family homes, condos, townhouses, and vacation rentals. Investors can earn rental income and benefit from property appreciation.

- Commercial Properties: These include office buildings, retail spaces, and industrial properties. They offer higher rental yields but may require more management.

- Industrial Properties: These include warehouses, manufacturing facilities, and distribution centers. They are typically leased to businesses for long-term contracts.

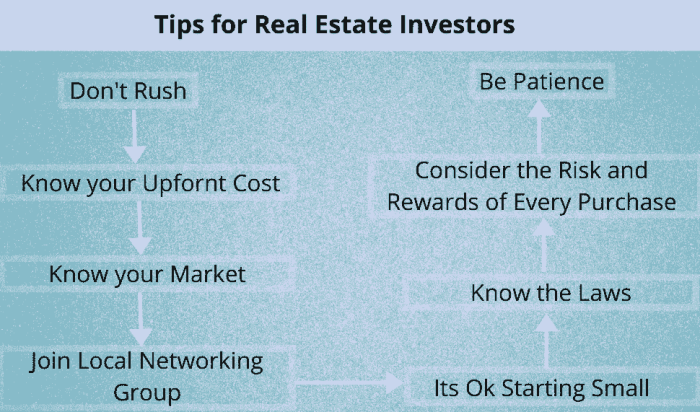

Factors to Consider Before Investing: Real Estate Investing Tips

Before diving into real estate investing, it’s crucial to assess various factors that can significantly impact the success of your investment. From location to market trends, here are some key considerations to keep in mind.

Location

When it comes to real estate, location is everything. A property’s proximity to schools, amenities, transportation, and job opportunities can greatly influence its value and rental potential. Conduct thorough research on the neighborhood’s growth potential and overall desirability before making a decision.

Market Trends

Staying informed about current market trends is essential for making informed investment choices. Keep an eye on factors like housing demand, pricing trends, and economic indicators to anticipate potential shifts in the market. Understanding these trends can help you make strategic decisions and maximize your returns.

Property Condition

The condition of a property can significantly impact its value and potential for returns. Before investing, it’s essential to assess the property’s structural integrity, maintenance needs, and potential for renovations or upgrades. Conducting a thorough inspection and working with qualified professionals can help you identify any red flags and make informed decisions.

Research and Due Diligence

Investing in real estate requires thorough research and due diligence. From analyzing market data to conducting property inspections, taking the time to gather relevant information is key to making successful investments. Ensure you have a solid understanding of the property’s history, potential risks, and growth prospects before committing your capital.

Risk Mitigation

Real estate investing comes with inherent risks, such as market fluctuations, vacancies, and unforeseen expenses. To mitigate these risks, consider diversifying your portfolio, conducting proper insurance coverage, and setting aside emergency funds for unexpected costs. Having a solid risk management strategy in place can help safeguard your investments and maximize your long-term returns.

Strategies for Successful Real Estate Investing

Real estate investing offers various strategies that investors can utilize to build wealth and achieve financial success. Understanding these strategies and knowing how to implement them effectively is key to maximizing returns and minimizing risks in this lucrative industry.

Buy and Hold Strategy

The buy and hold strategy involves purchasing properties with the intention of holding onto them for an extended period. This approach allows investors to benefit from property appreciation over time and generate rental income. By holding onto properties long-term, investors can build equity and create a stable source of passive income.

Fix and Flip Strategy

The fix and flip strategy involves purchasing distressed properties, renovating them, and then selling them for a profit. This strategy requires a keen eye for spotting undervalued properties and the ability to manage renovation projects effectively. Successful fix and flip investors can quickly turn properties around for a substantial profit.

Rental Properties Strategy

Investing in rental properties involves purchasing properties to rent out to tenants. This strategy provides investors with consistent rental income and the opportunity to build equity through property appreciation. Managing rental properties effectively and selecting reliable tenants are crucial to the success of this strategy.

Leveraging in real estate investing involves using borrowed funds to increase the potential return on investment. By leveraging other people’s money, investors can acquire more properties and maximize their profits.

Tips for Maximizing Returns and Minimizing Risks, Real Estate Investing Tips

- Do thorough research on market trends and property values before making any investment decisions.

- Diversify your real estate portfolio to spread out risks and maximize potential returns.

- Maintain a strong network of real estate professionals, including agents, contractors, and property managers, to help you navigate the market effectively.

- Regularly review and adjust your investment strategy based on market conditions and your financial goals.

Financing Options for Real Estate Investments

When it comes to financing real estate investments, there are several options available to investors. Understanding the pros and cons of each method and knowing when to use them can help you make informed decisions and maximize your returns.

Mortgages

One of the most common financing options for real estate investments is obtaining a mortgage. This involves borrowing money from a lender to purchase a property. Mortgages typically offer lower interest rates compared to other financing methods, making them an attractive option for long-term investments. However, securing a mortgage can be a lengthy process, and you need to have a good credit score and steady income to qualify.

Hard Money Loans

Hard money loans are another option for real estate investors, especially those looking to fund a property quickly or with less stringent requirements. These loans are typically provided by private investors or companies and are secured by the property itself. While hard money loans offer fast access to funds, they often come with higher interest rates and fees compared to traditional mortgages.

Private Financing

Private financing involves borrowing money from individuals or private companies instead of traditional financial institutions. This option can be more flexible in terms of loan terms and requirements, making it suitable for investors who may not qualify for a mortgage or hard money loan. However, private financing may come with higher interest rates and stricter repayment terms.

Tips for Securing Financing

- Improve your credit score by paying off debts and managing your finances responsibly.

- Prepare a solid business plan and investment strategy to present to lenders or private investors.

- Shop around and compare offers from different lenders to find the best financing terms for your investment.

- Consider partnering with other investors or pooling resources to increase your chances of securing financing.