Real Estate Investment Tips takes center stage in this guide, offering a fresh and insightful look into the world of real estate investing with a hip and engaging twist. Get ready to dive into the realm of financial opportunities and savvy investment strategies.

Importance of Real Estate Investment

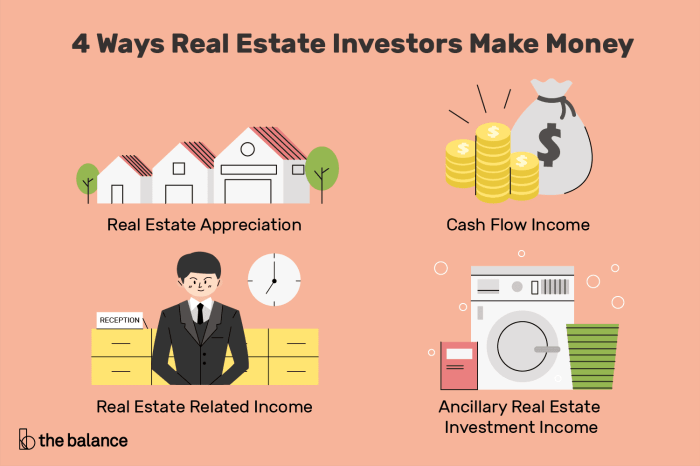

Real estate investment is considered a valuable asset class due to its ability to generate long-term wealth and provide a hedge against inflation. Unlike other investment options, real estate offers tangible assets that can appreciate over time, providing investors with a secure and stable source of income.

Benefits of Diversifying an Investment Portfolio with Real Estate

Diversifying an investment portfolio with real estate can help reduce risk by spreading investments across different asset classes. This can help protect against market fluctuations and economic downturns, ensuring a more stable and consistent return on investment. Real estate also has a low correlation with other financial assets, making it an attractive option for portfolio diversification.

Passive Income Streams from Real Estate Investments

Investing in real estate can provide passive income streams through rental properties, real estate investment trusts (REITs), or crowdfunding platforms. Rental properties can generate monthly rental income, while REITs and crowdfunding platforms offer investors the opportunity to earn dividends or interest payments without actively managing the properties. This passive income can help investors build wealth over time and achieve financial independence.

Types of Real Estate Investments

When it comes to real estate investments, there are various types that investors can consider. Each type comes with its own set of advantages and disadvantages, so it’s essential to understand the differences between them to make informed decisions.

Residential Real Estate

Residential real estate involves properties such as single-family homes, condominiums, townhouses, and apartments that are used for living purposes. Investing in residential real estate can provide a steady income stream through rental payments or appreciation in property value over time.

Commercial Real Estate

Commercial real estate includes properties like office buildings, retail spaces, and warehouses that are used for business purposes. Investing in commercial real estate can offer higher rental income compared to residential properties but may require more capital and expertise to manage.

Industrial Real Estate

Industrial real estate comprises properties like factories, warehouses, and distribution centers used for manufacturing or storage. Investing in industrial real estate can be lucrative due to long-term leases with established businesses, but it may involve higher risks and maintenance costs.

Retail Real Estate

Retail real estate includes properties like shopping malls, strip malls, and standalone retail stores. Investing in retail real estate can be profitable if located in high-traffic areas, but it may be susceptible to economic downturns and changes in consumer behavior.

Short-term vs. Long-term Investments

Short-term real estate investments typically involve buying properties to renovate and sell quickly for a profit, known as fix-and-flip projects. On the other hand, long-term investments focus on purchasing properties to hold for an extended period, generating rental income and potential appreciation.

Pros and Cons of Rental Properties vs. Fix-and-Flip Projects

Investing in rental properties can provide a steady passive income stream, tax benefits, and potential long-term appreciation. However, it requires ongoing management, maintenance costs, and dealing with tenants. Fix-and-flip projects offer quick profits but involve higher risks, market fluctuations, and capital investment for renovations.

Factors to Consider Before Investing

Before diving into real estate investments, it’s crucial to carefully consider various factors that can significantly impact your decision-making process. Conducting thorough research and analysis is essential to ensure a successful investment strategy.

Location

When evaluating potential real estate investments, location plays a crucial role in determining the property’s value and potential for appreciation. Factors such as proximity to amenities, schools, public transportation, and future development projects can significantly impact the property’s desirability and market value.

Market Trends

Understanding current market trends and forecasts is vital for making informed investment decisions. Analyzing factors such as supply and demand dynamics, interest rates, and economic indicators can help you assess the potential risks and returns associated with a particular real estate market.

Property Condition

Assessing the condition of the property is essential to determine the potential costs of repairs and renovations. Conducting a thorough inspection can help you identify any underlying issues that may affect the property’s value and investment potential.

Potential for Appreciation

Investing in real estate requires a long-term perspective, and considering the property’s potential for appreciation is crucial. Factors such as location, market trends, and future development plans can influence the property’s value over time, allowing you to maximize your return on investment.

Evaluating Risk and Return Potential

Before making any investment decisions, it’s important to evaluate the risk and return potential of real estate investments. Consider factors such as rental income, property appreciation, operating expenses, and financing costs to determine the overall profitability of the investment.

Financing Real Estate Investments

Investing in real estate can be a lucrative opportunity, but securing financing is a crucial step in making your investment dreams a reality. Let’s explore the different financing options available for real estate investments, the pros and cons of leveraging, and how you can improve your credit score to secure better financing terms.

Traditional Mortgages

Traditional mortgages are one of the most common ways to finance real estate investments. With a traditional mortgage, you borrow money from a lender to purchase a property, and then pay back the loan with interest over a set period of time.

Hard Money Loans

Hard money loans are another financing option for real estate investments. These loans are typically provided by private investors or companies and are secured by the value of the property being purchased. Hard money loans often have higher interest rates and shorter terms compared to traditional mortgages.

Crowdfunding

Crowdfunding has emerged as a popular way to finance real estate investments in recent years. Through crowdfunding platforms, investors can pool their resources to fund real estate projects. This can be a great option for those looking to invest in real estate with lower capital requirements.

Pros and Cons of Leveraging

- Pros: Leveraging can amplify your returns on investment, allowing you to control a more valuable asset with less of your own money.

- Cons: However, leveraging also increases risk, as you are using borrowed money to invest, which can lead to larger losses if the investment does not perform as expected.

Improving Credit Scores for Better Financing Terms

Improving your credit score is essential to securing better financing terms for your real estate investments. Here are some tips to boost your credit score:

- Pay your bills on time

- Keep your credit card balances low

- Avoid opening new credit accounts unnecessarily

- Regularly check your credit report for errors and dispute any inaccuracies

Real Estate Investment Strategies

Real estate investment strategies are crucial for success in the industry. By utilizing the right approach, investors can maximize profits and minimize risks. Here, we will delve into various strategies and provide tips on creating a tailored investment plan.

Buy and Hold Strategy

The buy and hold strategy involves purchasing properties with the intention of holding onto them for the long term. Investors benefit from rental income and property appreciation over time. This strategy is ideal for passive income and long-term wealth accumulation.

Fix and Flip Strategy

Fix and flip strategy involves purchasing properties below market value, renovating them, and selling at a higher price for a profit. This strategy requires a good eye for potential in properties and knowledge of the renovation process. It’s a more active approach to real estate investing.

Wholesaling Strategy

Wholesaling involves finding properties at a discount and then assigning the contract to another buyer for a fee. This strategy requires strong negotiation skills and a good network of buyers and sellers. It’s a low-risk strategy with potential for quick profits.

Rental Properties Strategy

Investing in rental properties involves purchasing properties to rent out to tenants. Rental income provides a steady cash flow and potential for long-term wealth accumulation. This strategy requires property management skills and knowledge of the rental market.

Tips for Creating a Real Estate Investment Plan

- Set clear financial goals and objectives.

- Research market trends and conditions.

- Diversify your investment portfolio.

- Consider your risk tolerance and investment timeline.

- Seek advice from experienced real estate professionals.

Adapting Investment Strategies Based on Market Conditions

Real estate markets are dynamic and subject to fluctuations. It’s essential for investors to adapt their strategies based on current market conditions. For example, in a seller’s market, it may be more profitable to focus on fix and flip strategies, while in a buyer’s market, buy and hold strategies could be more beneficial.

Real Estate Market Analysis: Real Estate Investment Tips

When it comes to real estate investment, conducting thorough market analysis is crucial to make informed decisions and maximize returns on your investments. By analyzing market trends, property values, rental demand, and economic indicators, investors can identify lucrative opportunities and mitigate risks in the real estate market.

Importance of Market Analysis

Market analysis provides valuable insights into the current state of the real estate market, helping investors understand the demand and supply dynamics, pricing trends, and investment potential in specific locations. By analyzing market data, investors can make strategic decisions, such as choosing the right property type, timing their investments, and optimizing rental income.

- Examine historical property values and price trends to identify potential growth opportunities.

- Assess rental demand in the market to determine the profitability of investment properties.

- Monitor economic indicators such as employment rates, population growth, and interest rates to gauge the overall health of the market.

Tools for Market Research

There are various tools and resources available to investors for conducting comprehensive real estate market research. These tools can help investors analyze market data, compare property prices, and track market trends effectively.

Online platforms like Zillow, Realtor.com, and Redfin provide access to market data, property listings, and comparative market analysis reports.

- Utilize real estate analytics tools such as Mashvisor and NeighborhoodScout to analyze property performance and neighborhood data.

- Consult with local real estate agents, property managers, and industry experts to gain insights into specific market dynamics and investment opportunities.

- Attend real estate seminars, workshops, and networking events to stay informed about market trends and connect with other investors in the industry.

Risk Management in Real Estate Investments

When investing in real estate, it is crucial to understand and manage the associated risks effectively to protect your investment and maximize returns. Here, we will explore common risks in real estate investments and strategies to mitigate them.

Common Risks in Real Estate Investments

- Market Fluctuations: Real estate markets can be volatile, leading to changes in property values and rental prices.

- Vacancies: Empty properties can result in loss of rental income and increase holding costs.

- Unexpected Expenses: Repairs, maintenance, or legal issues can arise, impacting profitability.

Strategies for Mitigating Risks, Real Estate Investment Tips

- Diversification: Spread your investments across different properties or locations to reduce exposure to market fluctuations.

- Insurance: Obtain property insurance to protect against damages, liability claims, or loss of rental income.

- Thorough Due Diligence: Conduct extensive research on properties, markets, and potential risks before making investment decisions.

Importance of Contingency Plans

Having contingency plans in place is essential to prepare for unexpected events that may impact your real estate investments. This could include setting aside emergency funds for repairs, having backup tenants lined up for vacancies, or having legal support for any unforeseen issues that may arise.